World Cup Ripples: Examining Messi & Mbappe Sports Cards After Historic Showdown

The 2022 FIFA World Cup had soccer fans watching with full attention as long-time soccer legend Lionel Messi’s Argentina team went down to the wire against rising star Kylian Mbappe’s France club. It ultimately ended with Messi capturing his first World Cup title while stopping France from becoming the first back-to-back World Cup winner since 1962.

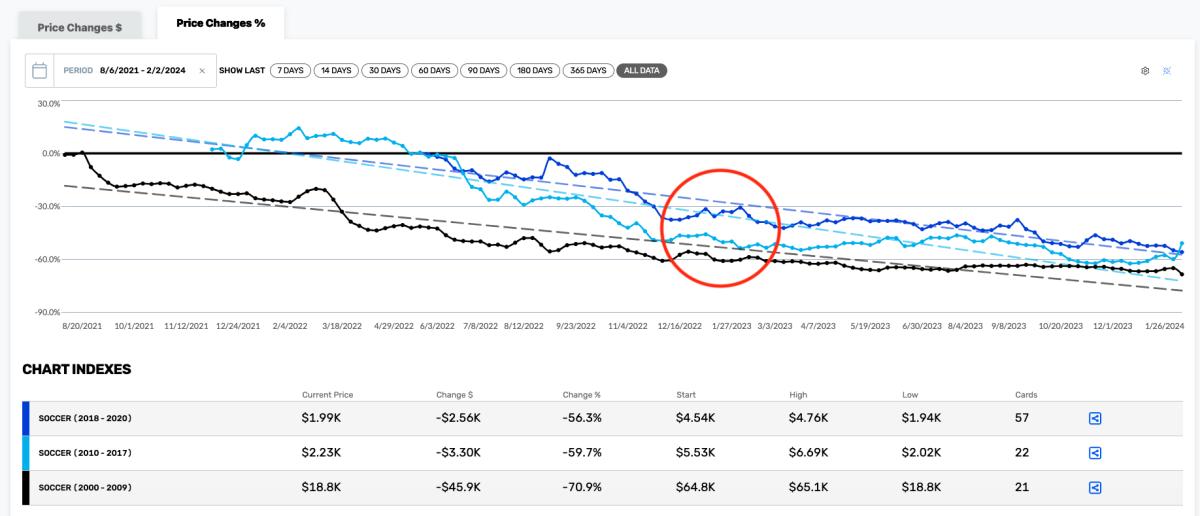

At the time, the market for soccer cards was still seeing a correction after a bubble from 2020 to 2021 drove prices to unprecedented and unsustainable levels. Despite a bearish market phase, soccer cards (released between the years 2000 and 2020) saw a healthy but short-lived spike in value that almost perfectly aligned with the 2022 World Cup, according to the Market Movers Market Pulse Index.

After months of decline, there was a short window of increased demand and pricing.

Since then, the market has continued to correct and sits at a current valuation that is just a fraction of what we saw in 2020 and 2021. So what has that meant for stars like Messi and Mbappe? Here’s a glance at their markets in the aftermath:

Lionel Messi

Messi has continued to provide plenty of excitement despite shifting into the later stages of his career. Along with the 2022 World Cup, Messi shocked the sports world with a move to Inter Miami. But has that hype been enough to keep his prices rising? The data says it hasn’t. In fact, since the World Cup and his move to MLS, Messi’s market has seen a significant decline.

Over the last 365 days, Messi’s entire graded card market tracked by Market Movers has seen a 9% drop in pricing with major hits to rookies in a variety of grades, outside of several of his most expensive options. Beyond those ultra-expensive cards, there have been several Messi options that have been popular targets over the last year.

Looking at World Cup cards, Messi’s 2022 Panini Instant World Cup Base PSA 10 has been a key card with more than 500 sales over the last 365 days. Despite being an on-demand print, this card has been by far his most sold PSA 10 tracked by Market Movers over the last year. Even with the high volume, it’s dropped in price 43% over that same period and is now trending around $116.

Messi’s second-most popular PSA 10 over the last year has been his 2014 Prizm World Cup Base with 235 sales. That card has also dropped 29% from around $165 to about $117.

Surprisingly, Messi’s key PSA 10 rookies haven’t seen similar trends to his more affordable graded counterparts. Messi’s 2004 Panini Megacracks Base #71BIS PSA 10, arguably his most important card, has actually seen a 21% increase across its two sales over the last year — it most recently sold at the end of January for just over $322,000. His 2004 Panini Megacracks #45 Base PSA 10 has seen a 2% bump over the last year as well and is now trending around $8,700.

So what does this mean? The data could suggest that, despite dips to other popular targets over the last year, some of Messi’s most exclusive and rare cards could sit in a position where they hold a level of immunity to general market shifts — his legacy and popularity could be playing a major part here.

Kylian Mbappe

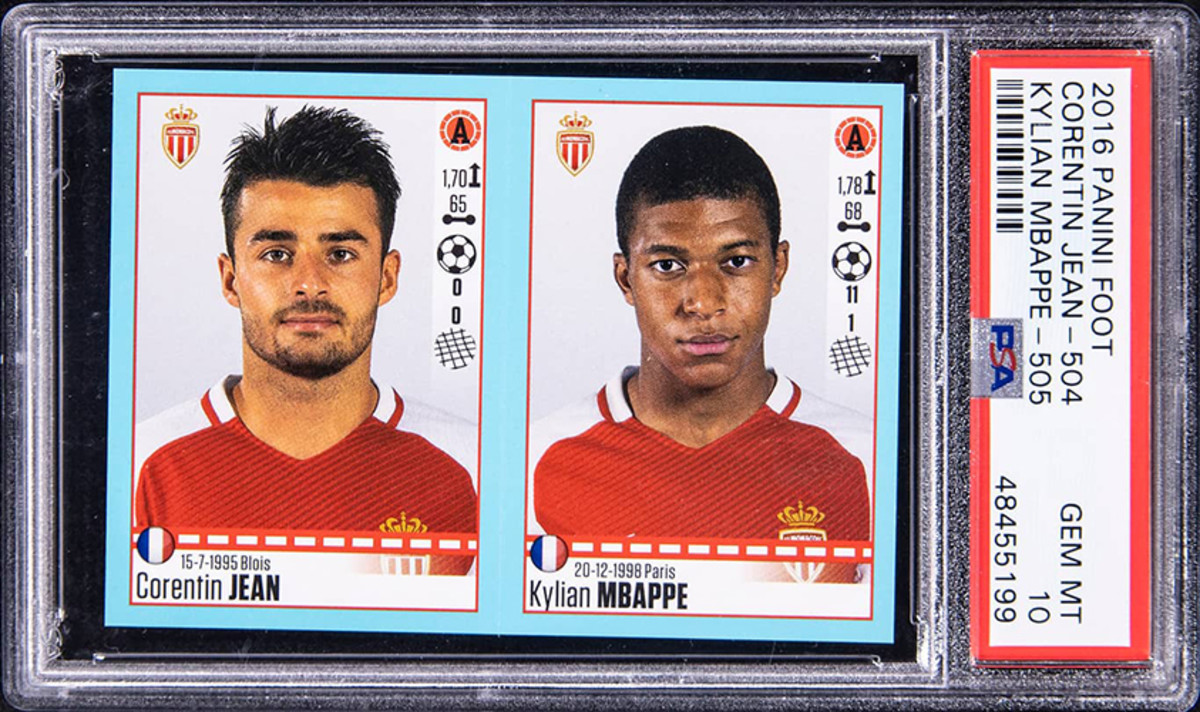

One might assume that Mbappe’s popularity would result in demand for his sports cards, especially amid transfer rumors. That hasn’t been the case though. Mbappe’s graded card market has seen a plummet of 27% over the last 365 days, and unlike Messi, 10 of his rookie PSA 10s have seen pricing decreases. Mbappe’s 2017 Topps Chrome UEFA Champions League PSA 10 has dropped 46% while his 2017 Select Field Level PSA 10 is down 37%. His 2016 Panini Foot Sticker Base PSA 10 has even dropped 36%.

From this we can gather that Mbappe’s card market has cooled off drastically since the World Cup showdown. This can likely be attributed to Mbappe’s youth and less-established presence in the soccer world. While there is no doubting he is an elite player and is likely to be a face of the sport for years to come, his card market just may not be able to provide immunity to pricing volatility like Messi’s.

The upside here is that you can buy several top Mbappe rookie cards during the dip and possibly capitalize when the 25-year-old superstar decides where he’ll be playing next. You could also wait for the next FIFA World Cup in 2026.

A Way-Too-Early Look at the 2026 FIFA World Cup

The 2022 World Cup could possibly serve as a template for how we can expect the sports card market, specifically the soccer market, to react to large events after the 2020 market boom.

With this in mind, it can be expected that there will be hype around key players like Mbappe or Jude Bellingham leading into the 2026 World Cup. We can also expect there to be some volatility in their markets throughout the tournament. While the previously mentioned data doesn’t suggest substantial spikes, it’s important to recognize external factors such as the bubble bursting and how they could have negated some of the expected price growth during an extremely popular time for soccer.

One area to focus on could be post-World Cup. Despite Messi’s PSA 10 rookie cards not seeing much negative movement over the last year, his graded card market as a whole saw significant downturns in pricing. Expect the hype driving card prices to quickly fade once the winner has been crowned in 2026, and expect pricing for top players to fall off in a similar fashion.