Low-Risk, High-Reward Wagers Have Professional Bettors Crying Foul

The abrupt end to the NCAA basketball season, due to the COVID-19 (coronavirus), has left professional and recreational bettors in a lurch. Professional bettors treat futures wagering as a form of low-risk, high-reward investment opportunities. Many high stakes bettors, who wished to remain anonymous, are disgruntled over the cancellation of the NCAA Tournament. These bettors placed futures wagers on specific teams months ago at long odds and now see those investments as worthless.

Many operators across the pond in the UK, as well as DraftKings and FanDuel here in the US, offer buy-out options on certain wagers. However, Vegas sportsbooks do not offer any such option to its patrons. Many of the sharp bettors I spoke with are looking for the Vegas sportsbooks to not just refund their wagers, but instead offer a buyout at a percentage of the perceived value of their tickets.

According to Jeff Sherman, SuperBook USA’s VP of Risk Management, his sportsbook will be refunding all bets on the 2020 college basketball national championship. Caesars Sportsbooks said it would “refund any associated wagers” for the cancelled NCAA Tournament, while adding “‘Futures’ wagers on the NBA, NHL and MLB will remain active until the professional leagues make a determination on how the seasons currently in suspension will conclude.”

FanDuel announced late Thursday that they would be refunding all futures wagers as well:

It's a confusing time in the sports betting world right now. See below for our latest update ↓

— FanDuel Sportsbook (@FDSportsbook) March 12, 2020

For any questions regarding your account, please contact our customer service team:

• Twitter: @FanDuel_Support

• Phone: 877-689-0662

• Email: sportsbook@fanduel.com pic.twitter.com/cIqqI8645G

For instance, let's look at this bettor at the Four Queens in downtown Las Vegas. Back in November, this bettor wagered that the Florida State Seminoles would win the NCAA Tournament at odds of 100-1. As of Thursday morning, nearly every shop around town was offering them at odds as low as 14/1 to as high as 22/1.

Tickets such as this one have professional bettors seeking some sort of return on their investment. The books have been holding onto their money for many months, in most cases, and the value of the ticket increased once the odds dropped on teams who exceeded the oddsmakers' expectations.

The bettors I spoke with equated futures betting markets to buying a stock at an IPO at $20 per share, seeing the stock grow to $20,000 per share, only to be told that they would be forced to sell back the stock at the original purchase price of $20.

In reality, these complaints will fall on deaf ears, as the most likely outcome will just be a refund of the original wager amount and no additional perceived value.

The claim of many of these bettors is that these teams did not even have to win the tournament in order to return money on their investment. Bettors proclaimed that once these teams—who would be heavily favored to win their opening round games—won, they would have tremendous hedge out value as the tournament progressed. For instance, a bettor who wagered on Florida State would have the opportunity to wager on FSU's opponent as the team advanced in order to lock in significant profit along the way.

In addition, many bettors choose to buy and sell futures wagers on propswap.com. According to their website, PropSwap is legal in 14 states: Arkansas, California, Connecticut, Illinois, Indiana, Kentucky, Massachusetts, Mississippi, Nevada, New Jersey, New York, Ohio, Pennsylvania, & West Virginia. It appears, per Patrick Everson of Covers.com, that as late as Wednesday night a buyer purchased a futures wager on the Butler Bulldogs:

Per @PropSwap, a $300 Butler NCAA championship wager at 500/1 odds -- for a potential win of $150K -- sold last night for $1,775. So the buyer's odds are 84/1. PropSwap points out that Butler is currently 55/1 at FanDuel and 40/1 at DraftKings. @Covers pic.twitter.com/lmHaQbidSt

— Patrick Everson (@PatrickE_Vegas) March 11, 2020

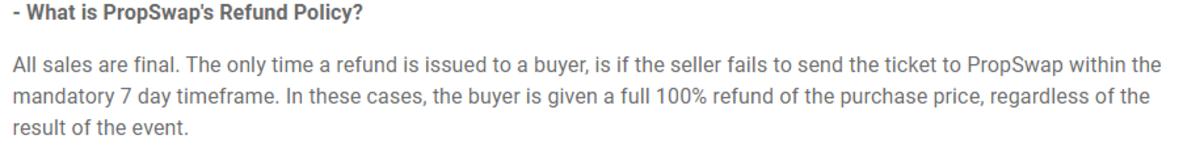

According to their website, all sales are final:

This would leave the question, what will happen to the buyers who have purchased futures tickets and paid more than the original wager amount like the one above? This buyer paid $1,775 for a ticket only worth $300 on a refund at the SAHARA Las Vegas Sportsbook.

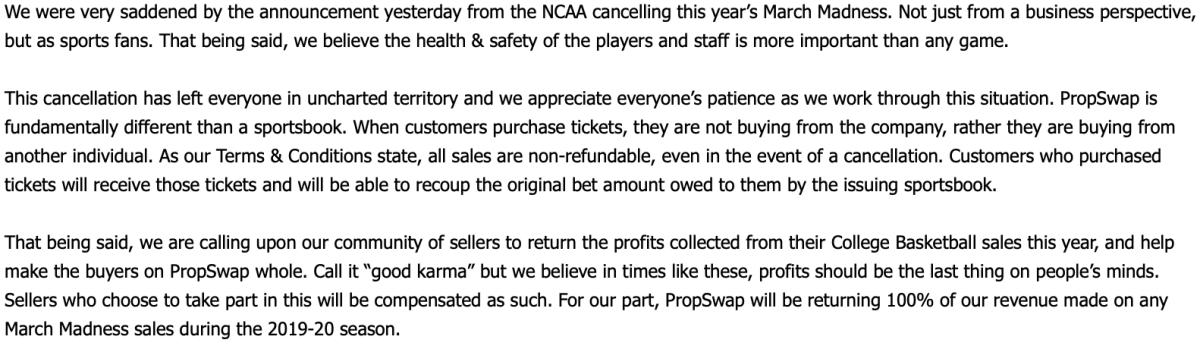

Here is PropSwap's official statement:

MORE FROM SI GAMBLING

When Will the NBA Return? New Prop Bet Being Offered

The 2020 AL Cy Young Is Gerrit Cole's to Lose...And He Will