How State Taxes Could Affect Where Bryce Harper and Manny Machado End Up

No matter where they sign as free agents, Bryce Harper and Manny Machado will break the bank. They could sign contracts that guarantee them more than $300 million, perhaps more than $400 million. Their deals will all but ensure that they and generations of descendants are financially set. Yet these two superstars will “take home” significantly higher or lower pay depending on which teams sign them and the applicable income tax rates in the states where those teams are based. This impact could be worth tens of millions of dollars. It is also heightened by a new federal law—the Tax Cuts and Jobs Act of 2017—which substantially limits the ability of taxpayers who itemize their deductions to deduct the dollars they spend paying state and local taxes on their federal income tax returns.

Harper, 26, is the most coveted free agent in baseball. With a career OPS of .900, the six-time All-Star rightfielder is one of baseball’s most feared sluggers. Harper has played his entire career with the Washington Nationals, who drafted him with the first overall pick the 2010 MLB draft. The Nationals are among the teams that could be vying for Harper. The Los Angeles Dodgers, New York Yankees, St. Louis Cardinals, Chicago Cubs, Chicago White Sox and, as detailed by SI’s Emma Baccellieri, the Philadelphia Phillies are also said to be in the mix. Each envisions Harper as entering his prime years and capable of elite performance for the duration of his inevitably lengthy contracy.

Machado, also 26, has plenty of suitors of his own. The shortstop/third baseman was selected by the Baltimore Orioles two spots after Harper in the 2010 MLB Draft. Since then, the four-time All-Star and two-time Gold Glove winner has been of the best infielders in the game. Machado is also coming off a terrific season. He belted 37 home runs in 162 games split between the Orioles and the Dodgers, who traded for him on July 17. The Dodgers, Yankees, Phillies, Cubs and White Sox are all linked to Machado.

Predicting Bryce Harper's Landing Spot and New Contract

There are many factors that influence players’ free agency decisions. Playing on a winning team, playing for a particular manager or with specific teammates, living in a favorable climate and being exposed to a certain culture are all part of the calculation. Family considerations and hometown nostalgia can also prove persuasive. The decision, in other words, is by no means “all about the money.”

Still, money matters. The teams in pursuit of Harper and Machado are in touch with each’s agent, Scott Boras and Dan Lozano, respectively. Consistent with their professional duty to maximize clients’ interest, Boras and Lozano will encourage teams to bid against one another. When it is advantageous for their clients, Boras and Lozano will flag tax considerations as altering the take-home value of offered contracts.

For example, assume the Cubs and Dodgers offer identical eight-year, $300 million contracts to Machado. Lozano would warn the Dodgers that their offer is decidedly inferior. As a Dodger, Machado’s million-dollar wages would be subject to the top bracket of California’s state income tax rate. At 13.3%, it is the highest rate in the land. In contrast, as a Cub, Machado would be subject to the comparatively modest 4.95% Illinois income tax rate. As shown in our chart below, the difference in after-tax value of these two $300 million contracts would be $14 million. Lozano would likely urge the Dodgers to increase their offer so that it would match the Cubs’ offer after taxes.

The difference between signing with a team in Illinois versus one in California is only amplified by the Tax Cuts and Jobs Act, which President Donald Trump signed into law in December 2017. Among other changes, the law lowers from 39.6% to 37.0% the federal income tax rate that applies to the highest earners (which is defined as single persons who earn more than $510,300 a year or married persons who earn more than $612,350 a year and file jointly). This is a positive change for Harper and Machado given that the vast majority of their salaries will be subject to the highest rate.

Winter Meetings Preview: Will Bryce Harper, Manny Machado Find New Homes?

However, the new tax law contains other features that could prove costly to Harper and Machado—depending on where they sign. One of the law’s more controversial features is how it approaches deductions. Deductions are reductions from a person’s adjusted gross income. In other words, they lower the amount of a taxpayer’s income that is subject to the federal income tax. Federal tax law provides taxpayers a choice to select the standard deduction (which is currently $12,020, $18,350 or $24,400 depending on filing status) or to itemize—meaning individually list their deductions. If one itemizes, allowable deductions include amounts paid on home mortgage interest and certain health care expenses as well as amounts paid on property, state, and local income taxes.

Historically, taxpayers with high levels of income have elected to itemize. This is particularly true when they pay substantial amounts in property and state income taxes. The new tax law, however, caps deductions for state and local taxes/property taxes to $10,000. This means that a homeowner who pays $9,000 in property taxes and $15,000 in state income taxes can no longer deduct $24,000 for those payments. Instead, the most they can deduct is $10,000.

The deduction cap is especially problematic for persons who live in states subject to relatively high income and property taxes. At the top of that list is California, and New York isn’t far behind. Both states impose high taxes on income and property. As a result, players who sign with the teams in those states will pay more to the government.

How much after-tax money would Harper and Machado be leaving on the table if they sign with a team in high tax state? Below we try to calculate these figures.

Before we do so, we acknowledge two key assumptions.

Where We Think Manny Machado Will Sign

First, our understanding is that Machado is a resident of Florida. As to Harper, we assume that he maintains residence in Nevada, his home state. Neither Florida nor Nevada has an income tax. This does not mean Machado and Harper will avoid state taxes, but it does potentially reduce the amount of state taxes they’ll pay. They’ll obviously have to pay federal income taxes. Likewise, they will owe “jock taxes”, which are taxes imposed by states and municipalities on the proportion of income attributed to athletes on visiting teams when they play games in those states and municipalities (we include estimates of jock tax payments in our state and local tax calculations). Their degree of exposure to state income taxes, however, would depend on whether they sign with a team that plays in a state with an income tax.

Second, we estimate that Harper will sign a 10-year, $350 million contract and that Machado will sign an eight-year, $300 million deal. These numbers are based on media accounts. We realize these figures might prove “way” off. This is especially true if Harper or Machado (1) opts for a shorter or longer contract than expected, (2) signs a contract that features opportunities for player and/or team opt-outs, or (3) agrees to defer much of the compensation to future years (a la Bobby Bonilla, who retired in 2001 but who the New York Mets are contractually obligated to pay $1.19 million every July 1 until July 1, 2035).

Consider the free agent market in December 2017. Media outlets reported that J.D. Martinez sought a seven-year, $210 million free agent contract. This type of deal never materialized. Instead, two months later, Martinez signed a five-year, $110 million free agent contract with the Boston Red Sox. As explained by SI’s Jon Tayler at the time, Martinez’s contract also contains two opt-outs. The larger point is predicting free agent contract amounts is hardly a science.

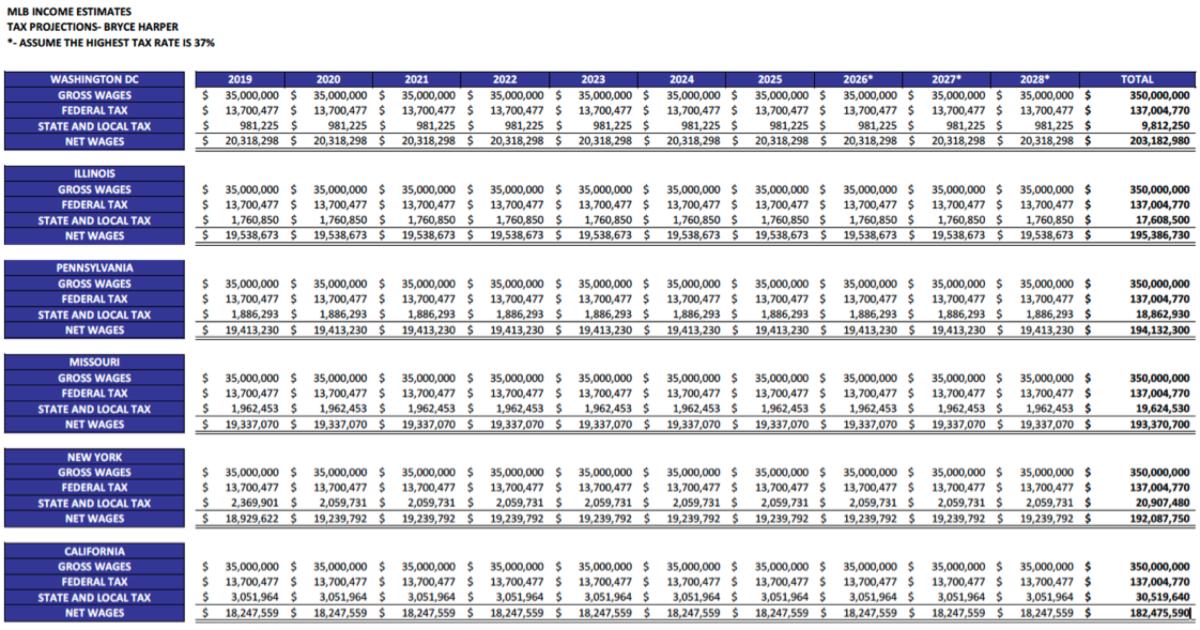

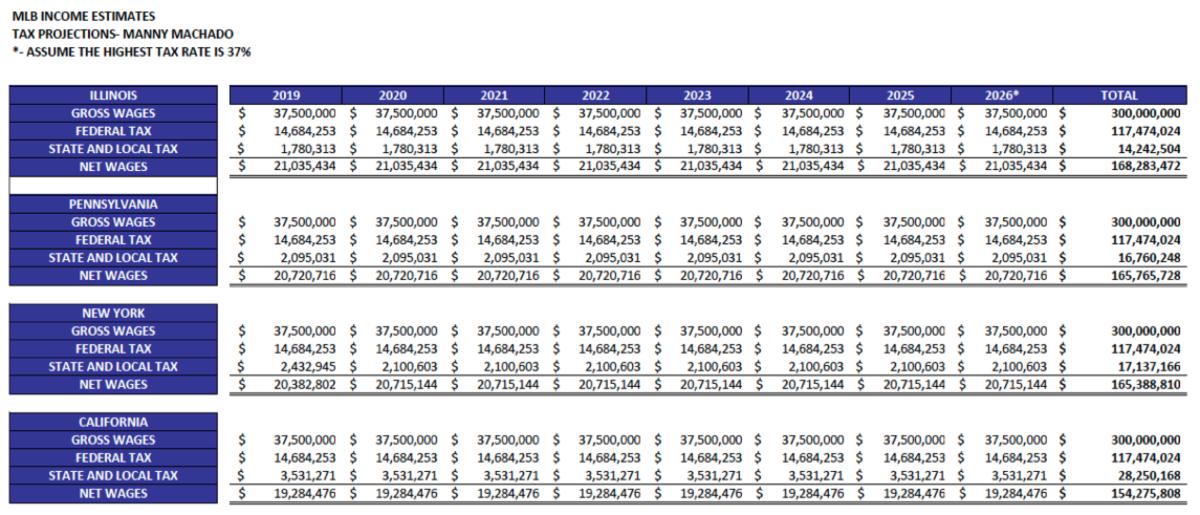

With these caveats in mind, we present what Harper and Machado would annually “take home” in contracts that offer each an identical amount of money ($35 million per year for Harper and $37.5 million per year for Machado):

Harper Projection:

Machado Projection:

These numbers show how much more Harper and Machado would earn by signing with teams that play in jurisdictions with relatively lower income taxes. Consider Harper. If the six teams mentioned above each offered him a 10-year, $300 million contract, the after-tax value of otherwise identical contracts would range from $203.2 million (Nationals) to $182.5 million (Dodgers). That is a difference of $20.7 million. Boras could use this difference to demand from the Dodgers that they offer more in order to account for California’s relatively onerous income tax.

The difference in offers to Machado is not quite as jarring, but it is still significant. Should Machado receive 8-year, $300 million contract offers from the Cubs, Phillies, Yankees and Dodgers, the Cubs would have the advantage. Machado would take-home $168.3 million from the Cubs, $165.8 million from the Phillies, $165.4 million from the Yankees and $154.3 million from the Dodgers.

The big winner in this analysis: the Nationals. Although Washington D.C. imposes an 8.95% tax on earnings in excess of $1 million, the tax does not apply to non-residents. As we assume Harper is a resident of Nevada (a state without an income tax), Harper remaining with the Nationals would be akin to signing with a team in a state without an income tax.

As we acknowledge earlier, there is much more to the story than taxes. There are numerous non-monetary considerations in a player’s decision to sign. Plus, monetary considerations go beyond contract values and taxes. Cost-of-living figures, for example, vary widely by locale. According to Bankrate.com, a person who relocates from Miami to New York City would need to double their salary to maintain the same standard of living. Endorsement and entertainment opportunities are also influenced by a player’s geographic choice. Dodgers players, for example, may have more professional opportunities outside of baseball that monetize their name, image or likeness than Cubs players.

Still, when two contracts of identical monetary values are in “taxpayer reality” worth tens of millions of dollars apart, players may face a more complicated decision than meets the eye.

Michael McCann is SI's legal analyst. He is also the Associate Dean for Academic Affairs at the University of New Hampshire School of Law.

Robert Raiola is the Director of the Sports & Entertainment Group of the CPA and Advisory Firm PKF O’Connor Davies.