A's Looming Relocation Caveat

A couple of days ago we mentioned three reasons why the A's relocation approval does not in fact mean that the Las Vegas relocation is a done deal. At least not yet. There are still hurdles in the way for John Fisher to clear, and one of the ones that was mentioned was the caveat that was added into the relocation vote.

We now have the details of that caveat, thanks to Bob Nightengale of USA TODAY. Here is what he wrote: "There’s a provision in the agreement called a 10-year flip tax, MLB executives told USA TODAY Sports, to prevent Fisher from using the relocation simply to increase the value of his team and immediately sell. MLB gave Fisher about a $300 million break by not charging him a relocation fee, but if he turns around and tries to sell the team, he’s going to have to pay a stiff penalty. The agreement, an executive told USA TODAY Sports, requires Fisher to retain the team until at least 2028 when they are scheduled to open in Las Vegas. If Fisher sells before 2028, he will be taxed 20% of the purchase price, which will be split among owners."

He goes on to say that the tax goes down to 10% if he sells in 2029, and that the tax rate goes decreases each year from 2030-33. The first year that Fisher could sell the A's tax free while moving forward with the Las Vegas plan would be 2034.

This is a pretty smart move by the owners, who obviously don't trust Fisher any more than the rest of us. It also means that Fisher would be 72 by the end of the ten-year period.

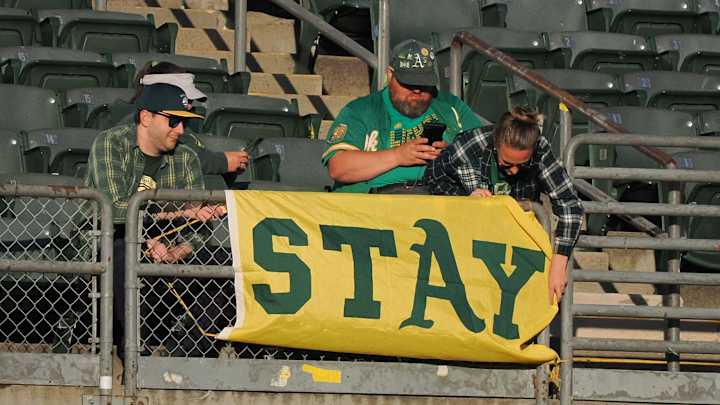

While the move to Vegas is the most likely path forward still, this entire relocation has been based upon numbers on a spreadsheet, not loyalty to any region or fan base. Well, those numbers may have just changed.

If Fisher were to sell the team in 2028, right when they got to Las Vegas, he'd be selling at the highest value for the franchise, but would also have to pay the highest tax rate. If the franchise was sold for $2 billion, then he would owe the other owners $400 million, or a little more than the relocation fee that was waived.

If he waited another year until 2029, the value of the franchise may dip a little, but let's keep it at $2 billion. He'd then owe the other owners $200 million.

While the way that Fisher and MLB have treated Oakland sure make it seem like they have no intention of ever having baseball back in the East Bay again, there are two factors that could be working in Oakland's favor. The first is that a new ballpark wouldn't need a roof due to the excellent weather year round. The second is that Fisher could sell the team whenever he'd like in the process and not have to invest in the club ever again. He sure wouldn't have to increase payroll for that first season in Las Vegas, either.

The A's have maintained for awhile now that they need the surrounding development at Howard Terminal to make the project work, but they aren't getting that in Vegas. If Fisher wants to attempt to repair his legacy and still make gobs of money in the process, then the tax the owners will impose on him for the next ten years could be the kick in the pants he's needed to re-open negotiations with Oakland.