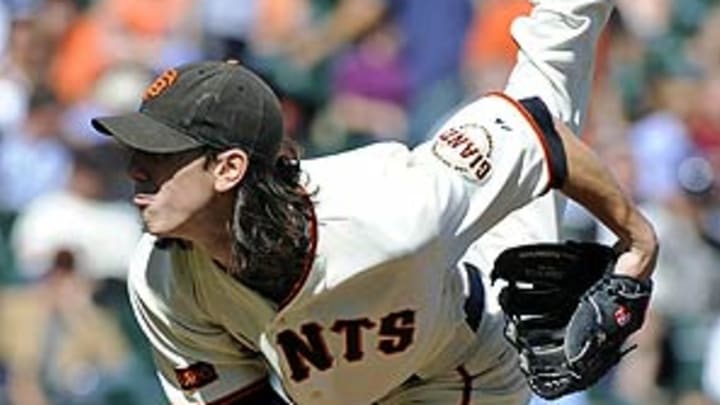

Lincecum could raise the bar for elite players in arbitration

The arbitrators, who are not baseball experts, are supposed to decide on which salary is most fair (they must pick either the player's figure or the club's). What makes things difficult is that the arbitrator can't simply decide this based upon a player's true monetary value to his team. If they did, the players would win nearly every time. Whether Lincecum gets $8 million or $13 million, he is still an absolute bargain for the Giants. Any other team in the game would love to have Lincecum for that price. What's tricky is that the arbitrator isn't expected to rule on Lincecum's actual value to the Giants, but simply what has been a "fair" price in the past for a player at his level of service and performance. So even though Lincecum is every bit as good as CC Sabathia and his $23 million dollar contract, there's no way that the 25-year-old Lincecum could expect to win that much in an arbitration case. Why a player's time in the big leagues should affect his salary more than his actual value to his team doesn't make a whole lot of sense, but that's the reality of the system.

The oddity of salary arbitration is that it's almost entirely self-driven. Arbitrators are supposed to rule based upon what players with comparable service levels are earning. But how have those comparable players' salaries been determined? Through rulings of other arbitrators! As a result, the arbitrators are in almost complete control over the salaries of players in the early to middle part of their careers. A few stray rulings here or there that are favorable to either the players or the owners can affect the market for years to come. That's why the Lincecum case will set an important precedent. If the arbitrators rule for the Giants, they'll have pegged Lincecum's salary at about 30 percent of what he could earn on the open market. If they rule for Lincecum, he'll get about 50 percent of his market value.

To get an idea of what's reasonable, one can a take a look back at arbitration though history. In 1983 Dodgers phenom Fernando Valenzuela earned a record $1 million arbitration settlement. Valenzuela had finished first and third in the NL Cy Young Award voting the previous two years and was one of the best arms in the game. Meanwhile, the top free-agent contract belonged to Dave Winfield, who earned $2 million per year. While Valenzuela and Winfield were players of comparable talent and value, Valenzuela, because he was not a free agent, made only half as much as Winfield.

One might guess that the ratio of top arbitration compensation to top free-agent compensation would remain fairly constant over time. However, as the graph below shows, it rose during the late 1980s and early 1990s. In 1992 Ruben Sierra was awarded $5 million in arbitration to play for the Texas Rangers. Meanwhile, Bobby Bonilla was the highest-paid free agent, making $5.8 million. This meant that the top arbitration player was making 86% of what the top free agent player could pull in. Other arbitration-eligible players around that time were also cashing in. Don Mattingly, Doug Drabek and Jack McDowell also all had arbitration rulings that gave them salaries of around 70% of what the top free agents made.

But during the 1990s a funny thing happened. Top salary arbitration figures remained constant while top free-agent salaries rose sharply. For the rest of the decade, no one eclipsed McDowell's record arbitration award of $5.3 million, while the top free-agent salary doubled from Cecil Fielder's$7.2 million to Kevin Brown's $15 million. Indeed, by the turn of the 21st century, the highest arbitration salary was less than 40% of what the top free agent player could earn. Part of the reason for this is that many players with four or five years of experience settle without ever reaching arbitration, but the picture is clear that arbitration was not as lucrative as it used to be relative to free agency. Sierra would never make more than 80% of A-Rod's $27.5 million salary through arbitration today.

The bad news for Lincecum -- and the good news for the Giants -- is that this figure has remained between 30%-40% for the past decade. Ryan Howard, Francisco Rodriguez and Alfonso Soriano each were awarded $10 million salaries in arbitration over the past few years. Taking 40% of A-Rod's $27.5 million salary yields a figure of $11 million -- right in between the offers of Lincecum and the Giants.

While arbitrators are supposed to look for comparable players in terms of skill and service time, there are very few comparables to Lincecum. Only a handful of other pitchers have ever won back-to-back Cy Young Awards, and even fewer have done it so early in their careers. While there isn't a recent pitching comparison for Lincecum, the Howard comparison is fairly apt. Both had more than two years of MLB experience, and while Lincecum has his Cy Youngs, Howard had racked up a Rookie of the Year Award, an MVP Award and a fifth-place finish in the MVP voting. Like Lincecum, Howard was one of the most valuable young stars in the game. In 2008 Howard offered $10 million to the Phillies' offer of $7 million and won. Lincecum is attempting to push the envelope further by offering $13 million.

The MLBPA would love to see a return to the days when the top arbitration-eligible players would earn nearly 70-80% of their true market value, rather than the 40% that has been the norm in recent years. If arbitration salaries had kept pace with free-agent contracts over the past 20 years, perhaps Lincecum could get away with asking for $18 million. Likewise, it might be different if Lincecum were in his final year of arbitration eligibility, rather than his first year. Lincecum's $13 million bid is still reasonable, though it's far from a guaranteed winner. Based on precedent, the "fair" salary for Lincecum would probably be $10-11 million. However, the arbitrators will be forced to choose between the two disparate figures. Baseball insiders will be waiting with bated breath for the ruling to come down. When it does, the result will set a new precedent on what elite players in their arbitration years can earn. For a first-year arbitration eligible player to earn more than 50% of his market value would be a sizeable shift. Starting today, we'll see if it happens.