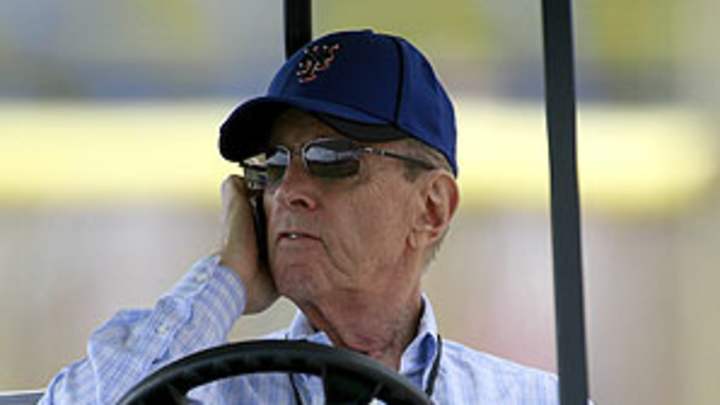

Madoff fallout may well force Fred Wilpon to sell his beloved Mets

PORT ST. LUCIE, Fla. -- Despite the Wilpons' continuing public statements that they intend to keep control of the Mets, high-ranking people around baseball are extremely concerned about whether well-liked owner Fred Wilpon will be able to hold onto his beloved Mets long-term.

Word is that commissioner Bud Selig, Wilpon's longtime friend and ally, is going to give him substantial time to sort through the Madoff mess. Selig surely hopes that Wilpon will hold onto the team. But neither Selig nor anyone else knows whether Wilpon will be able to do that. Wilpon has said that he's not selling controlling interests, just a small piece of the team -- 20-to-25 percent, he says -- and he maintained again on Thursday his belief that he will weather a storm that he admitted has put an incredible "tax'' on his family.

But Wilpon is not likely to truly know for sure yet whether he can keep the Mets in his family, as he had always hoped. He is fighting a claim by Madoff trustee Irving Picard for up to $1 billion, and while one securities lawyer told SI.com he believes that figure is quite a "reach'' by Picard, it isn't even certain whether Wilpon can withstand a hit for half that amount, or even a quarter of it.

Wilpon is known throughout the game as a man of integrity, and he asserted at Mets camp on Thursday that "we will be vindicated,'' that he knew nothing of the $20 billion fraud that his longtime friend Bernie Madoff perpetrated. Wilpon pointed out that he had put more money into his Madoff account within weeks before Madoff was arrested, and of course that nobody of sane mind would do that had they known the Madoff funds were all one big scam.

Picard is doing his best to recover money for the victims of the scam, and he has said that he doesn't consider Wilpon or his partner Saul Katz true victims. Picard has further asserted in the suit he's filing against Wilpon and Katz that they had to know that Madoff's operation was a fraud. But while common sense would suggest that it isn't possible to make almost exactly the same 10-to-12 percent annual return for decades, Picard hasn't convincingly explained why Wilpon "should have known'' any more than any other Madoff victim should have known.

But there doesn't appear to be any true smoking gun to suggest that Wilpon knew, and Wilpon said on Thursday that he turned over 700,000 pages of documents to Picard. There is plenty of correspondence contained in those pages from folks warning him and Katz that Madoff is "too good to be true,'' or something along those lines, but nothing has come to light from Wilpon saying that he believed the warnings or knew of anything illegal.

Wilpon asserted that his returns were no different than those of all the other victims. So it's hard to see where he should be treated any differently from them, except that if Picard's claim that the Wilpons/Katzes withdrew more than they deposited is true, they should be made to pay the difference to the trustee. If they are indeed "net winners,'' that should be rectified.

"We had nothing to do with it,'' Wilpon said. "We were duped.''

Wilpon's defense, which is an interesting one, is that he didn't know what was going on, and suggests a stark lack of sophistication in the ways of the stock market, especially for someone who was once worth a billion dollars. He says, in effect, that he made a poor choice to invest with a crook.

I believe him. Look at his and the Mets' track record -- he has had a history of poor choices. He thought former Mets manager Art Howe "lit up a room.'' And it isn't just Howe. The Mets have had several bad to mediocre managers.

They've had some questionable general managers, too. Al Harazin didn't seem to know much about baseball. Others have had different deficiencies, and failing skill sets. They had an assistant GM whom they eventually threw out for having a foul temper.

The Mets have had some questionable characters in the clubhouse, too, from steroid dispenser Kirk Radomski to horse player Nick Priore to memorabilia seller Charlie Samuels.

There has been a long enough track record of bad decisions to believe that Bernie Madoff was merely the worst in a long litany of them.