Analyzing the NBA's Proposed Schedule and Playoff Format Changes

The NBA and National Basketball Players’ Association are considering sweeping changes to the league calendar beginning in the 2021-22 season. According to a story by ESPN’s Adrian Wojnarowski and Zach Lowe, the changes would include a 30-team in-season tournament that occurs in late November into mid-December, a postseason play-in format and a reseeding of the four conference finalists.

These kinds of major, arguably radical, revisions to the league’s structure will demand persuasive advocacy and careful negotiations.

Should a league that is doing well rock the boat?

Advocates of these reforms can readily identify the NBA’s weaknesses. The league relies heavily on the marketing of star players, but sometimes those star players rest as part of load management—much to the disappointment of ticketholders and television viewers. To that point, TV ratings for NBA games broadcast on ESPN and TNT were down 16% during the first month of the 2019-20 season. Tanking also remains a concern, yet recent adjustments to lottery odds ought to diminish incentives to tank. Tampering has also been problematic, though new and stricter compliance rules are designed to combat it. As the recent China quandary shows, the NBA is also vulnerable to risks inherent in expanding into a country that controls businesses and is resistant to dissenting political views.

Despite these hurdles, the NBA is, by most objective measures, extremely successful.

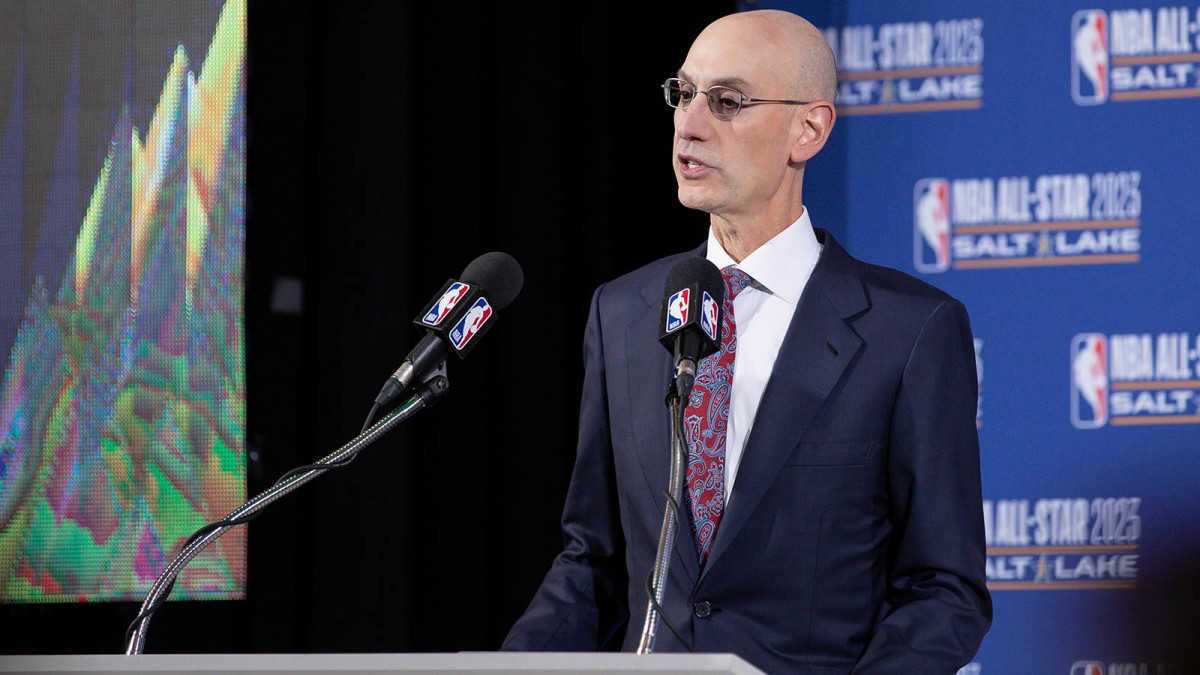

Take league revenues. They have steadily climbed under the leadership of commissioner Adam Silver. From when he took office in 2014 to 2018, NBA revenues jumped from $4.56 billion to $8.01 billion. Franchise values have also soared. As recent Forbes data shows, the average NBA franchise is worth $1.9 billion, up 13% over just one year. Franchises are also more profitable than ever.

Player salaries have likewise jumped. According to Basketball Reference, the average player salary in the NBA is $7.7 million and the median salary is $3.5 million. These salary figures are the highest in the NBA’s history and exceed medians and averages found in the other major U.S. pro leagues. The NBA has also enhanced its minor league, the G League. The G League now features more competitive salaries and opportunities for college-aged players frustrated by NCAA amateurism rules to develop their talents in a pro-environment.

Wide-ranging changes to the NBA’s core product—the delivery of entertainment through basketball—are thus not without risk. The NBA will want to carefully assess whether changing its formula is a wise, forward-looking strategy or an unnecessary risk that could backfire.

The league appears to be banking on the idea that some of the proposed changes are popular in other leagues. The Premier League, for example, has done well with multiple types of tournaments during a season. Yet it’s not clear if NBA fans, who are accustomed to longstanding conventions for the NBA season, would embrace such change.

The NBA also seems to value that the rumored changes would address areas of concern. A postseason play-in, for instance, would mean that additional NBA teams have opportunities to make the playoffs. That dynamic should sustain fans’ interest in additional teams towards the end of the regular season and also combat teams’ incentives to tank. Meanwhile, an in-season tournament could raise the stakes of regular-season games, particularly if coaches and players were sufficiently incentivized to feel that way. That, in turn, could make coaches more inclined to play star players and worry less about load management.

Game-planning how these changes would be made by the league governed by a CBA

While the merits of these changes are important to consider, the mechanics of adopting and implementing changes are also crucial. Significant negotiations will be necessary, not only between the NBA and NBPA but also between the league and its broadcast partners and sponsors. Teams, moreover, would need to tweak their contractual understandings with sponsors, venues, food and beverage providers and regional sports networks. None of those areas of negotiation is likely to doom the NBA’s plan. However, each will take time and, in some instances, necessitate reworking deals.

As a starting point, the CBA between the NBA and its players would need to be modified or amended. The CBA features numerous and often specific rules pertaining to regular season and postseason formats. The current CBA runs through the 2023-24 season, with a mutual opt-out clause after the 2022-23 season. Those dates are potentially problematic since the NBA would reportedly prefer the changes take effect during the 2021-22 season, which will be commemorated as the league’s 75 anniversary season.

Altering an existing CBA presents logistical challenges. Typically, management and labor prefer to defer substantive changes to players’ wages, hours and other working conditions until the two sides sit down to negotiate a new CBA. This is true for a variety of reasons, including that CBAs are fundamentally about compromise. One side gives and the other gets, and vice-versa.

For instance, during a CBA negotiation, the NBPA might seek a higher minimum pay scale for players. As a trade-off, the NBA might ask for greater league discretion on the use of wearable technologies. The two topics are basically unrelated but they can be “traded” for one another in a labor negotiation. Both sides are then better off: each has advanced one of their negotiation priorities.

This type of labor wheeling-and-dealing is less possible for standalone, one-off negotiations between management and labor. The ESPN story indicates that the NBA and NBPA have found common ground thus far in the negotiations. It also stresses that the league is committed to ensuring that players at least break even financially. Still, until the details are ironed out, the NBPA will surely scrutinize how structural changes impacting revenue would be absorbed by the players.

Players and owners split, almost evenly, basketball-related income or BRI. This term includes revenue generated by NBA broadcasts, apparel contracts, arena signage and other properties. The annual salary cap is determined by the amount of BRI, and the size of the salary impacts the dollar value of contracts teams can offer payers. To oversimplify, players are paid more if BRI goes up and are paid less if BRI goes down. The salary cap for the 2019-20 season is $109.1 million, a healthy increase from recent seasons ($101.9 million for 2018-19 and $99.1 million for 2017-18).

Like owners who might be wary of the impact of the NBA’s plans on their franchises’ values and profitability, players will want to see empirical data to support changing a formula that has made them very wealthy.

In addition to seeing the math, NBA players might demand a good faith pledge by the NBA to support NBPA priorities during the next CBA.

For example, it’s widely thought that the NBPA would like to change Article X of the CBA. Under Article X, an American player must be at least 19 years old and at least one NBA season must have elapsed since when he graduated from high school or, if he didn’t graduate, when he would have graduated. Article X forbids the career path taken by a number of recent NBA stars, including LeBron James, Kobe Bryant and Kevin Garnett. They skipped college for the NBA. The NBA, and particularly Silver, seems amenable to restoring the opportunity for high school players to jump to the NBA—especially with the G League becoming a more attractive option for players deciding whether to turn pro out of high school or go to college for a year or two.

Identifying sections of the CBA that would likely need to be amended

A review of the current CBA reveals where changes would probably be required to make these new ideas work.

Article XX, Section 4, for example, could be relevant depending on whether games during the in-season tournament count as “regular season”, as that term is understood in the CBA. In its section on definitions, the CBA defines the “regular season” as “the period beginning on the first day and ending on the last day of regularly scheduled (as opposed to exhibition or playoff) competition between NBA teams.” Meanwhile, the league constitution, which governs the legal relationship between teams and the league, defines a “regular-season game” as “any game included in the Association’s schedule of regular-season games during a Season, and shall not include Playoff Games or Exhibition Games.” It’s possible the tournament games could count as exhibition games or some other category that doesn’t yet exist in the CBA. Regardless, per Article XX, Section 4, “each year the NBA shall establish the schedule of regular season and playoff games in its discretion, provided that the number of days beginning on the date of the first regular-season game and continuing through the date of the last regular-season game each season shall equal approximately 177.” It’s unknown at this time if the reform plans would alter the 177-day rule.

Article XX, Section 7 is also of potential interest, particularly if the in-season tournament requires teams to travel long distances. This portion of the CBA dictates that “no team shall be required to play a scheduled game on the same day that such Team has traveled across two time zones” except in the event of “unusual circumstances” and only if the NBPA consents. The NBA, of course, can easily avoid this concern by adopting a travel schedule that comports with the requirement.

Article XX, Section 8 could also prove germane since it mandates that teams provide a minimum of 18 days off for each of its players during the regular season. A “day off” is not just a day without a game. It’s a day where a player is not obligated to partake in any team activity, including games, practices, travel and promotional activities.

Articles XX and XXIII, in conjunction with the Uniform Player Contract, are also potentially applicable should the changes lead to more required exhibition play (depending on how an in-season tournament is classified). Players can only be asked to play up to six exhibition games before the regular season begins, and only up to three exhibition games once the regular season starts. Further, the NBA must use “best efforts” to ensure that any exhibition game does not lead to “excessive travel” and that “reasonable periods of time” between exhibition games be used.

Article XXIX also appears on point. It instructs that the number of teams participating in the playoffs be 16 teams (though this section also says the NBA can increase that number). Also, each round of the playoffs must use the best-of-seven-games format. The play-in format would seem to contemplate a different arrangement than a best-of-seven series. In addition, Article XXIX discusses the calculation of “duty days”, which is particularly relevant to players on two-way and 10-day contracts. A duty day is one when a player is on his team’s active or inactive list. Per Article XXIX, the calculation of duty days involves multiplying a number of teams by 2,480 days. Whether this same formula makes sense in a reviewed season is unclear.

Meanwhile, Article XX, Section 3 instructs that “each team agrees that in no event will it play more than 82 regular-season games.” As reported by ESPN, the current version of the reform plan would involve teams paying between 78 and 83 games, depending on their success in the in-season tournament. Sports Illustrated has learned that the only way a team could get to 83 games is if it participates in the play-in playoff. This means the 82-game number will not require a tweak from 82 to 83.

TV networks, RSNs and other interested parties and their contractual preferences

The NBA has signed lucrative TV deals with ABC, ESPN and TNT, along with the league-owned NBA TV. Along those lines, the league is in the middle of nine-year deals with ESPN and TNT that pay the NBA (and, in turn, teams and players) $24 billion. Those deals were signed in 2014. At the time, the networks made revenue projections likely based on relatively static assumptions about the league’s calendar. Significant changes to the calendar could throw those projections off.

Networks might also have concerns about the impact of calendar changes on their broadcast lineups and advertisers’ preferences. Would an in-season tournament mean a surge in fan viewership during tournament games, followed by diminished ratings in non-tournament games? Would the schedule of the tournament alter the network’s agreements with other content producers? Obviously, ABC, ESPN and TNT broadcast different kinds of shows. NBA games are only a piece of a network’s scheduling lineup. A change to the lineup of NBA broadcasts therefore impacts other scheduling decisions. The value for advertisers in paying to air commercials during NBA games is also impacted, and such value alters how much the NBA’s broadcast partners can anticipate in revenue.

It’s unclear whether the NBA’s contracts with networks would require modifications on account of calendars changes but odds are that would be necessary. Such modifications could change the financial values and structure of broadcasting contracts with the NBA, including in ways that place more risk on the NBA—and, because of BRI, on players, too.

Meanwhile, each NBA team has its own TV deal(s) to broadcast most of their exhibition and regular-season games. These deals are typically with regional sports networks (RSNs), which are sometimes owned by the same person or group who owns the NBA team. The same set of concerns discussed above for ESPN and TNT are true with RSNs and their commercial sponsors. Teams, in other words, will likely need to engage in negotiations with RSNs.

The relevant impacts for calendar changes are not only concern TV broadcasts. NBA teams play in arenas that host other events, often including NHL games and music concerts. Some NBA teams own their arenas, whereas others don’t. Changes to the NBA season, particularly the addition of in-season tournament, would impact the availability of arenas for NBA games and other events.

Teams and arenas also employ food, beverage, dance, security and parking companies to provide various services. Those arrangements would need to be revisited with a differently designed NBA season. The same is true of deals with companies that sponsor signage and other promotions.

The bottom line: the NBA deserves credit for not thinking myopically about the future of NBA basketball. However, the rumored plans come with risk and would require substantial negotiations with the wide range of entities who are involved in the production of NBA games.

Michael McCann is SI’s Legal Analyst. He is also an attorney and the Director of the Sports and Entertainment Law Institute at the University of New Hampshire Franklin Pierce School of Law.