Trading for Chris Paul might not be in the Knicks' best interest

Rumors surfaced on Thursday about the Knicks potentially looking to make a move for Chris Paul this summer.

On the surface, that seems like it could be a good move. The Knicks have craved for an above-average point guard since... Stephon Marbury? It's tough to even pinpoint exactly when the team last had someone really worth investing in at that position.

Paul, meanwhile, is putting up a strong campaign for Oklahoma City in his age-34 season, and is a large reason that a team many thought would be in the hunt for a top draft pick is now in a heated battle for a top-4 seed in the Western Conference. Paul is averaging 17.5 points per game on an efficient 48.8% from the field and 60.6 TS%, and his career-low 6.7 assists per game can be pretty easily explained away by the backcourt timeshare between himself, Shai Gilgeous-Alexander and Dennis Schröder in OKC.

As much as bringing Paul in probably triggers old dreams of a Carmelo Anthony/Amar'e Stoudemire/Chris Paul trio in many Knicks fans' heads (and Anthony maybe shouldn't be ruled out for next year, either), the timing just isn't quite perfect now for three reasons: trade cost, contract value and opportunity cost.

Trade cost

Prior to this season, Paul was used essentially as a salary filler to match up with Russell Westbrook in Houston's trade to reunite James Harden with his old running mate. Oklahoma City was paid for Westbrook, but also for Houston to get off of Paul's three remaining years on his four-year, $159.7 million max contract extension he signed when he was traded to the Rockets as an expiring deal prior to the 2017-18 season. But more on the contract in a moment.

Now, however, Paul has managed to prove that he's much more than a salary filler. He obviously isn't owed all the credit for the Thunder's success this year, but the team is playing playoff basketball in a year when many expected them to chase ping-pong balls. Paul is undoubtedly a large part of that, playing with a chip on his shoulder that he surely developed from being treated as a filler/salary dump in the Westbrook deal.

What this means for the Knicks, though, is that trading for Paul this time around won't be a situation where they're getting paid to take on a bad contract, as it was for the Thunder last year. With Paul next year, the Thunder would be paying just over $100 million in salary to their roster, putting them pretty close to the salary cap, which projects to be around $113-115 million.

There's no real motivation for the Thunder to break up this burgeoning playoff team, however — Gilgeous-Alexander will still have two years left on his rookie deal, and some consistent contributors like Terrance Ferguson and Darius Bazley are under contract on their rookie deals as well. The Thunder, also, for all of Sam Presti's front-office savvy, have never really been a draw for free agents; meaning, they shouldn't be all that desperate to clear salary. That means that if the Knicks want to pry Paul, it's likely going to cost them some combination of their young players and future picks, which seems less than ideal.

Even if it only cost, say, Kevin Knox and the Mavericks' 2021 first rounder (the Knicks will have ample cap room this summer to absorb Paul into space), what is the ceiling of a Paul-led Knicks team? It could definitely be argued that Paul — combined with the likes of RJ Barrett, Mitchell Robinson, Julius Randle and Frank Ntilikina — could potentially lead the Knicks back to the playoffs. But surer things than that roster have found a way to fail in New York, and that leads right into the next point...

Contract value

As previously mentioned, Paul's contract still has two years left after this season. Well, technically one plus one — Paul's 2021-22 salary of $44,211,146 is a player option, but he's on record just over a month ago saying there's "no chance" he'd opt out of that final year to facilitate a trade. That makes perfect sense, given Paul helped negotiate the terms of the new collective bargaining agreement that even allowed him to get that $44.2 million salary in the first place, and he doesn't figure to ever receive that substantial of an offer again on the open market.

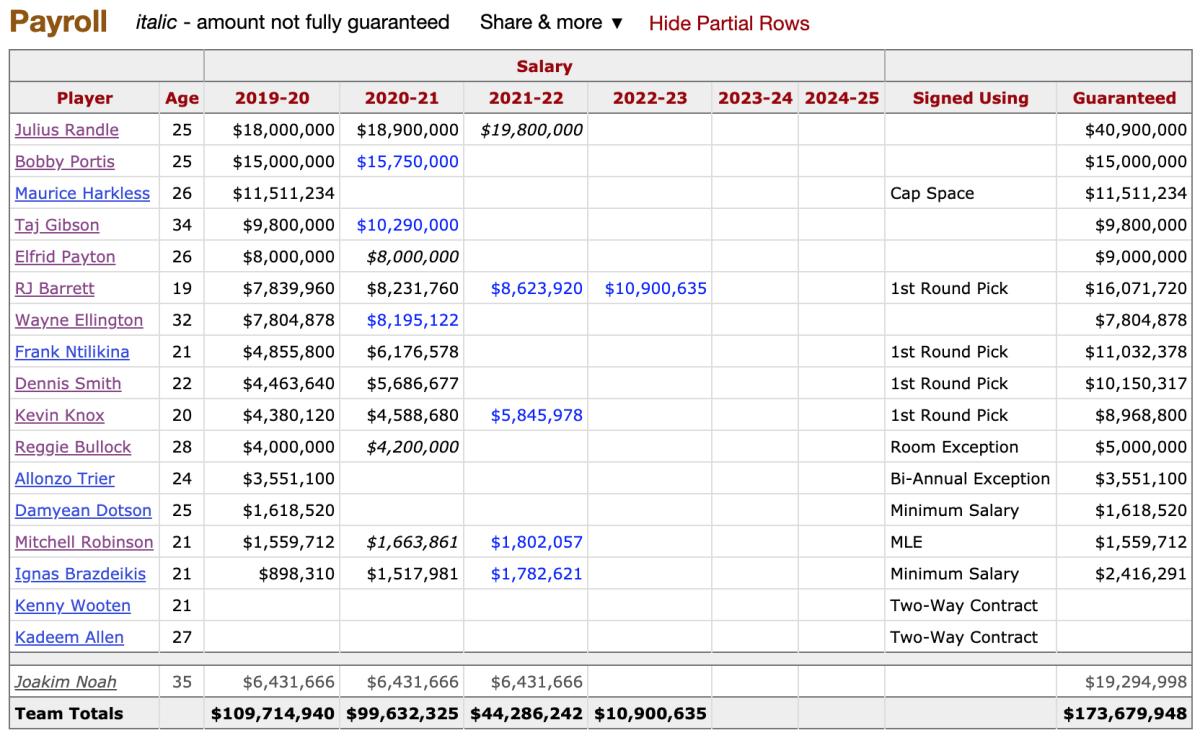

So what does that mean for the Knicks if they were to take on Paul's massive salary? Take a look at the Knicks' salary chart for the next few years, per Basketball-Reference:

If the Knicks opted out of Julius Randle's $19.8 million salary for 2021-22, they would be in a position to have around $35-40 million total on their books (depending on where their draft picks land) going into a star-studded 2021 free agent class that could potentially feature Kawhi Leonard, Paul George, Giannis Antetokounmpo, Jrue Holiday, Victor Oladipo, Rudy Gobert and, yes, even LeBron James. This season's salary cap is $109.14 million. Despite the fallout of the Daryl Morey-China situation, the salary cap is still projected to go up to around $113-115 million for the 2020-21 season, and presumably will climb slightly again for the 2021 free agent class.

That means that, without Paul, the Knicks could be looking at a situation where they have as much as $75 or so million in salary cap room, depending on what they do with some of their young players. That amount of space is almost enough to sign two 10-plus year veterans to max contracts, and two 7-9 year veterans to max deals with room to spare. That pie-in-the-sky thinking has doomed the Knicks before (look no further than last summer), but one would think that with former super-agent Leon Rose at the helm, the Knicks' chances in free agency should get better before they get worse.

With Paul, however, the Knicks could be looking at a situation where getting even one max spot could be tenuous. Suddenly, the team would then be on the hook for anywhere between $80-90 million, which also then makes it more difficult to potentially re-sign Ntilikina or Dennis Smith Jr. while still leaving room for improvement in free agency. Which sort of leads into the final point...

Opportunity cost

"Opportunity cost" is kind of a silly phrase that gets thrown around a lot in NBA writing, but in the case of this deal, it's warranted. Opportunity cost is defined as "the loss of potential gain from other alternatives when one alternative is chosen." In this case, the Knicks deciding to go in on Paul for two years as their point guard is losing them potential gain from the 2020 draft.

The 2020 draft, thus far, has been shaping up to be one of the weaker ones in recent years. One thing that seems mostly agreed-upon, however, is that this class is chock full of point guard talent. LaMelo Ball is generally considered the top option, but he's followed by the likes of Tyrese Haliburton, Killian Hayes, Cole Anthony, Theo Maledon, Nico Mannion and others. Add in combo guards Tyrese Maxey and RJ Hampton, and there's a lot of talent to be had in the first 10 or so picks at the lead guard position.

Now, the draft takes place (presumably) before the Knicks would be trading for Paul. But in today's NBA, it would be foolish to think that the Knicks wouldn't already have a good idea about trading for Paul before they have Adam Silver walk their pick up to the podium. On a roster that already has Frank Ntilikina and Dennis Smith Jr., would the Knicks draft a point guard and trade for CP3? It seems unlikely.

So if the Knicks end up dropping from their current projected No. 4 spot in the lottery and have ruled out a point guard in the draft, that could lead to a difficult decision if some of the better wings and bigs go early. Some mock drafts have Israeli forward Deni Avdija rising towards the top of the draft, where shooting guard/wing Anthony Edwards has been residing for months. With those two off the board, the Knicks would have the ball-handling guards mentioned above available, and then some questionable fits with Mitchell Robinson like centers James Wiseman and Onyeka Okongwu. Not exactly an ideal outcome.

All of this is to say, trading for Paul isn't necessarily a bad move on the surface. If the Knicks could somehow get him more or less for free, or — in a weird dream scenario — get paid by the Thunder to take him, the deal could probably be justified. But given the three factors above, it just doesn't seem like a move that's right for a young team that has tons of salary flexibility going forward. Paul, at this point in his career, is more of a finishing piece to a great team, and the Knicks are anything but close to a finished product.