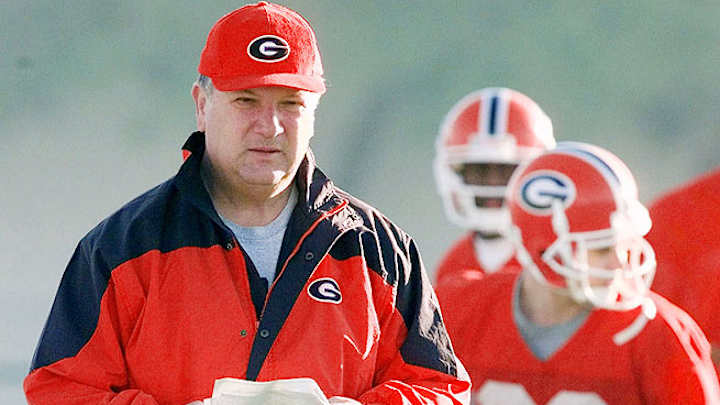

Ex-UGA coach Jim Donnan charged in Ponzi scheme

Former University of Georgia football coach Jim Donnan and a business partner face charges that they operated a Ponzi scheme, according to federal indictment unsealed Tuesday.

The grand jury last week returned the 85-count indictment against Donnan and Gregory L. Crabtree of Proctorville, Ohio. The charges include conspiracy, mail fraud and wire fraud, among others.

Charles Cox, a lawyer for Crabtree, said his client entered a not guilty plea at his arraignment Tuesday in Macon and was released on bond.

"We have no other comment, as neither Mr. Crabtree nor I had seen the indictment before this afternoon," Cox wrote in an email. "The not guilty plea he entered today was the first step in his defense of these charges."

A lawyer for Donnan did not immediately respond to calls and an email seeking comment. Donnan was also set to make his initial court appearance Tuesday, but it wasn't immediately known if he appeared.

The indictment says the pair ran the scheme through GLC Limited, Inc., a West Virginia-based company that dealt in closeout merchandise. Crabtree was president of the company and was responsible for its day-to-day operation, while Donnan's main role was to recruit investors, the indictment says. The pair offered and sold short-term investments, and promised investors rates of return ranging from 50 percent to 200 percent.

Investors generally weren't given much information about the deals but threw their money in because they trusted Donnan. He and Crabtree routinely lied to investors about the nature of the business, the indictment says.

GLC had little income other than the investments, so money from new investors was continually needed to pay expenses, to pay Crabtree and Donnan and "to perpetuate the scheme by paying what was falsely represented to investors as being a return on their investment from sales," the indictment says. Between September 2007 and October 2010, the pair raised more than $81 million from 94 investors.

The indictment identifies investors only by their initials. But the U.S. Securities and Exchange Commission last year filed a complaint against Donnan and others, saying the ex-coach used his influence to get high-profile college coaches and former players to invest $80 million into a Ponzi scheme. That case is still pending in federal court in Atlanta.

The individual losses ranged from a few thousand dollars to about $4 million, an SEC official said last year.

Donnan's attorney has previously acknowledged the former coach was paid lucrative commissions, but he said Donnan believed he was being paid from legitimate profits.

Donnan was head football coach at Marshall University from 1990 through 1995 and at the University of Georgia from 1996 through 2000 and later became an ESPN analyst.

Among the coaches Donnan helped attract were Texas State football coach Dennis Franchione; Virginia Tech football coach Frank Beamer; ex-Dallas Cowboys coach Barry Switzer and University of Cincinnati football coach Tommy Tuberville.

Donnan used his influence with former players who looked up to him, federal regulators said. According to the SEC court filing last year, he told one player, "Your Daddy is going to take care of you," and, "if you weren't my son, I wouldn't be doing this for you," the SEC complaint said. That former player, who was not named, ended up investing $800,000.

In late 2009 or early 2010, Crabtree told Donnan that GLC could no longer pay the rates of return Donnan was promising investors. The company began missing interest payments due to investors in August 2010.

Neither Donnan nor Crabtree disclosed GLC's financial problems to new investors. And Donnan, with Crabtree's knowledge, continued raising funds for deals while promising future returns, the SEC said.

Ultimately, a group of investors forced the appointment of a restructuring officer to run GLC. As the officer began to uncover the fraud, Crabtree resigned. In February 2011, the restructuring officer had GLC file a voluntary bankruptcy petition.

Donnan and his wife also filed for bankruptcy, and creditors claimed the Donnans owed them more than $40 million. A federal judge in Georgia approved a settlement in the case last July and, a judge in Ohio, where GLC is being restructured in bankruptcy court, also signed off on the settlement.