Taxes and a Quirk of the NFL Draft System: Why it Could Pay to Be Picked a Little Later

The 2020 NFL draft will be full of intrigue, not only for the usual player and team drama but also because it will be conducted through a virtual structure. Commissioner Roger Goodell will announce the picks from his home, while team executives and coaches will work remotely using videoconference technology.

Trades could cause the draft order to change before the first round kicks off at 8 p.m. ET on Thursday. For now, the New York Giants will select fourth overall and the Miami Dolphins will pick fifth. Normally, it’s better to be drafted earlier than later. While the draft is hardly an exact science—198 players were taken before Tom Brady in 2000—and while many picks reflect team needs rather than the proverbial “best player available,” the player picked fourth should be a better prospect than the one picked fifth. That doesn't mean that will be reflected financially, though–at least not this year.

It all breaks down as follows: Both players will sign four-year contracts that contain a fifth-year team option. Per the league’s rookie wage scale, the player picked fourth will sign a contract worth more in pre-tax dollars than the one picked fifth. This reflects the structure of the scale, which contemplates salaries that descend with draft order.

According to Spotrac, the player picked fourth projects to sign a contract with the Giants that will have a total value of $33.2 million, with a $21.7 million signing bonus. The player selected one spot later is expected to sign with the Dolphins for a total value of $31.1 million, with a $20.1 million signing bonus. In other words, the player picked fourth will sign a deal worth about $2.1 million more than the player picked fifth.

Clearly, both players will soon become very rich. But because of differences in state tax laws, the player selected by the Dolphins is positioned to “take home” more money than the player picked by the Giants a spot earlier. Stated differently, the player set to be paid less money will actually take home more money.

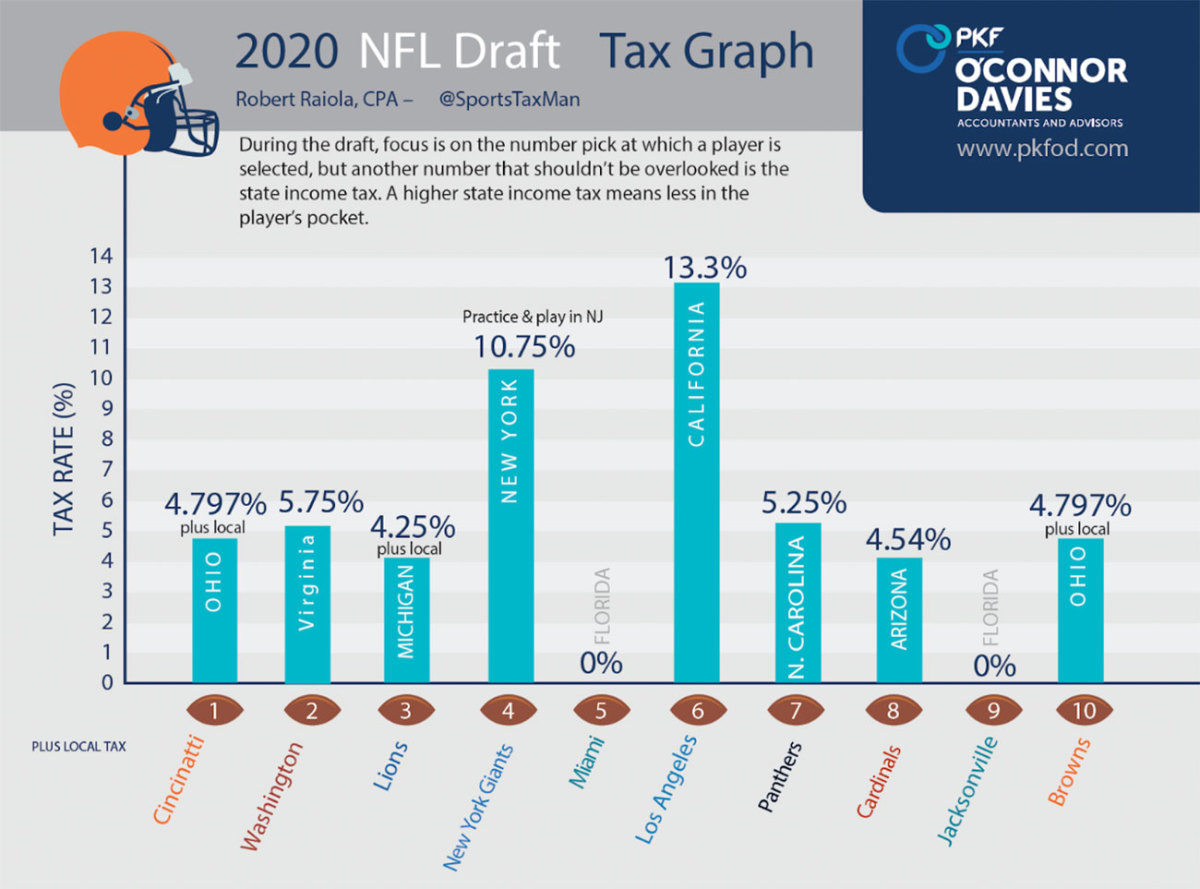

Florida is one of nine states without an income tax for wages. The soon-to-be Dolphin will thus avoid paying a type of tax that players drafted by teams in states with income taxes face. Here are the state tax projections for the teams currently picking in the top 10:

That’s not to say the Dolphins player won’t lose a sizable portion of his paycheck to the government. State income taxes aren’t the only type of income tax. All of the first-round picks will pay in the highest federal income tax bracket (37%) for the portion of their income that exceeds $518,401 (or, if married filing jointly, income that exceeds $622,051.) These players will also be subject to jock taxes, which refer to taxes imposed by states and municipalities on the proportion of income attributed to athletes on visiting teams when they play games in those states and municipalities.

Still, the Dolphins player, despite being picked after the Giants player and despite signing a less lucrative contract, is set to become richer. This is because while the Dolphins player avoids state income taxes, the Giants player will be subject to taxes reflecting that he is performing work at MetLife Stadium in East Rutherford, New Jersey. New Jersey imposes an income tax rate that varies based on income level. For income between $500,001 and $5 million, the rate is 8.97%; for income in excess of $5 million, the rate is 10.75%.

So, how do the numbers work out? We project the $33.2 million for the Giants player nets to $17.4 million, while the $31.1 million for the Dolphins player nets to $19.6 million. Although the Giants player will “make” $2.1 million more, the Dolphins player will “take home” $2.2 million more. These numbers factor in both federal income and jock taxes. Also, we assume the player resides in the same state of their team (if the Giants player opted to live in New York City, for instance, he would be subject to additional taxes and the difference in take-home pay would be even greater).

Obviously, post-tax pay is not the only way of assessing whether the player picked by the Dolphins is better off than if the Giants had nabbed him a spot earlier. This player might be more likely to succeed with one team and its coaching staff than he would with the other. With one team he could eventually be cut; with the other he might complete his entire contract and then sign a lucrative extension. There’s no way of knowing at this point. He might also have more family and friends near one city than in the other. His endorsement opportunities might vary, too. Per Nielsen’s designated market area rankings, New York is the largest market in the United States while Miami is 16th (though how well he plays and how much fan interest he generates would likely have a more substantial impact on his endorsement opportunities than market size). There are tons of variables.

Still, there is something peculiar about a wage scale that is designed to pay earlier-picked players more money being overmatched by state tax laws. It’s not as if these laws are hidden or confusing. They are publicized and straightforward.

Addressing the issue, however, would invite its own set of complications. The wage scale could be adjusted so that it takes into consideration state income taxes. This means contract dollar values could be increased or decreased so that take-home pay reflects built-in tax differences. Yet that type of adjustment could cause salary cap complications, unless each team’s salary cap level was also adjusted to reflect state income tax variations (and also, perhaps, cost of living differences). The player could also be traded at some point during his contract to a team located in a state with a different tax scheme—would his contract value change as a result? That doesn’t seem practical.

More likely, the rookie wage scale will remain unadjusted and state tax differences will continue to be a quirk of the system.

Michael McCann is SI's legal analyst. He is also the Director of the Sports and Entertainment Law Institute at the University of New Hampshire Franklin Pierce School of Law.

Robert Raiola is the Director of the Sports & Entertainment Group of the CPA and Advisory Firm PKF O’Connor Davies.

• Question or comment? Email us.